All Categories

Featured

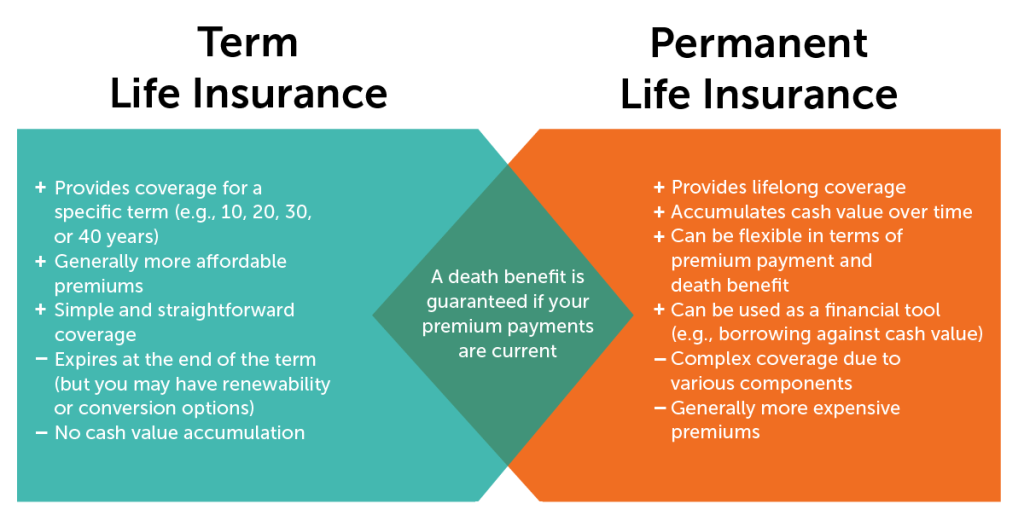

Cash money value is a living advantage that stays with the insurer when the insured dies. Any kind of impressive loans versus the cash worth will certainly lower the policy's survivor benefit. Retirement planning. The policy owner and the guaranteed are typically the very same individual, yet sometimes they may be various. As an example, a business could get key person insurance on a vital worker such as a CEO, or an insured could sell their own plan to a third party for money in a life settlement.

Latest Posts

Final Expense Insurance For Parents

Published Apr 11, 25

3 min read

Final Expense Life Insurance For Seniors

Published Apr 10, 25

6 min read

Funeral Plans With Immediate Cover

Published Apr 09, 25

8 min read