All Categories

Featured

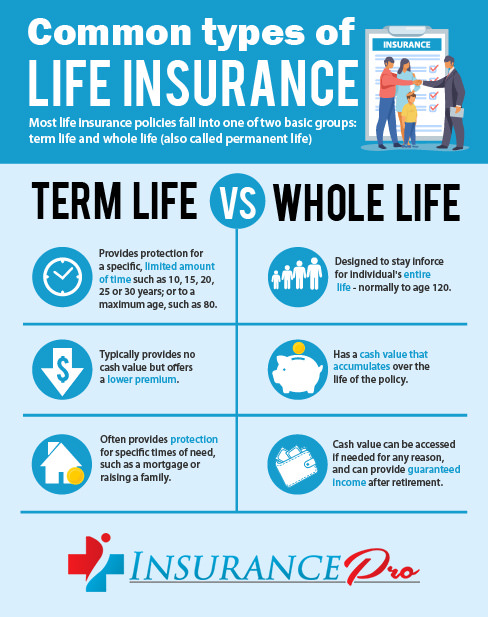

Money worth is a living benefit that remains with the insurance coverage company when the insured dies. Any type of exceptional financings against the money worth will certainly minimize the policy's death benefit. Term life. The policy proprietor and the guaranteed are generally the exact same individual, however in some cases they may be various. A company might acquire crucial individual insurance policy on a crucial staff member such as a CEO, or a guaranteed may offer their very own plan to a third event for cash money in a life negotiation - Senior protection.

Latest Posts

Final Expense Insurance For Parents

Published Apr 11, 25

3 min read

Final Expense Life Insurance For Seniors

Published Apr 10, 25

6 min read

Funeral Plans With Immediate Cover

Published Apr 09, 25

8 min read